ThredUp’s 13th Resale Report Shows Online Resale Saw Accelerated Growth in 2024 and Is Expected to Reach $40 Billion by 2029

59% of consumers say if new government policies around tariffs and trade make apparel more expensive, they will seek more affordable options like secondhand.

48% of consumers say personalization, improved search, and discovery make shopping secondhand apparel as easy as shopping new.

39% of younger generation shoppers have made a secondhand apparel purchase on a social commerce platform in the last 12 months.

OAKLAND, Calif.–(BUSINESS WIRE)–

ThredUp (Nasdaq: TDUP, LTSE: TDUP), one of the largest online resale platforms for apparel, shoes, and accessories, today released the results of its 2025 Resale Report. Conducted by third-party retail analytics firm GlobalData, the 13th annual study serves as the most comprehensive measure of the secondhand market globally and in the U.S., with forward looking projections through 2034. It also includes new insights about tariff and trade implications, how social commerce and AI are reshaping retail, and the government’s role in managing textile waste. The report’s findings are based on market sizing and growth estimates from GlobalData, a survey of 3,034 U.S. consumers over the age of 18, and a survey of 50 top U.S. fashion retailers and brands.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250319230685/en/

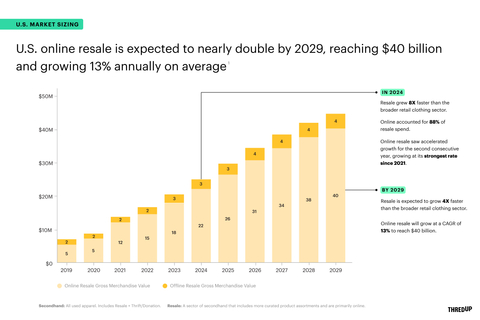

U.S. online resale saw accelerated growth in 2024 for the second consecutive year.

“As consumers are increasingly thinking secondhand first, the retail industry is adopting powerful new pathways for resale. From the integration of social commerce and innovative AI applications to the establishment of trade organizations and interfacing with government, it’s clear why resale is seeing accelerated growth and has such a promising growth trajectory.”

– James Reinhart, CEO, ThredUp

“Resale continues to outpace the broader retail sector, with online resale in particular driving the sector’s growth. Shoppers are prioritizing quality as resale value becomes an increasingly important factor in purchasing decisions, and retailers are evolving their secondhand offerings to meet consumer demand with new avenues like social commerce, further driving adoption and preference for secondhand.”

– Neil Saunders, Managing Director, GlobalData

The top five trends from ThredUp’s 2025 Resale Report:

(all figures pertain to the U.S. unless otherwise noted)

In 2024, the U.S. secondhand apparel market saw its strongest growth since 2021. Online resale saw accelerated growth for the second consecutive year.

- The global secondhand apparel market is expected to reach $367 billion by 2029, growing at a compound annual growth rate (CAGR) of 10%.

- The U.S. secondhand apparel market is expected to reach $74 billion by 2029.

- The U.S. secondhand apparel market grew 14% in 2024, seeing its strongest annual growth since 2021 and outpacing the broader retail clothing market by 5X.

- In 2024, online resale saw accelerated growth for the second consecutive year at 23%, growing at its strongest rate since 2021. It’s expected to nearly double in the next 5 years, growing at a CAGR of 13% to reach $40 billion by 2029.

Tariffs are expected to provide a tailwind to the secondhand market as shoppers prioritize affordability and retailers seek stability.

- 59% of consumers say if new government policies around tariffs and trade make apparel more expensive, they will seek more affordable options like secondhand. This figure is highest among Millennials at 69%.

- Consumers plan to spend 34% of their apparel budget on secondhand in the next 12 months. This figure is higher among younger generations (Gen Z and Millennials) who say they’ll spend nearly half (46%) on secondhand.

- 80% of retail executives expect new government policies around tariffs and trade to disrupt their global supply chain.

- 44% of retail executives are looking to reduce reliance on imported goods, and 54% of retail executives believe resale offers a more stable and predictable source of clothing in the face of potential tariff fluctuations.

Retailers view resale as a new revenue stream that helps them stay competitive and acquire new customers.

- 94% of retail executives say their customers are already participating in resale – an all-time high, +4 pts from 2023.

- 32% of consumers who bought secondhand apparel in 2024 made a purchase directly from a brand. 47% of younger generations did.

- 47% of consumers are more likely to make a first-time purchase with a brand if they offer shopping credit for trading in used apparel, +25 pts from 2023.

Retailers can unlock revenue by integrating social commerce and resale for omnichannel success.

- 39% of younger generation shoppers have made a secondhand apparel purchase on a social commerce platform in the last 12 months. 28% of consumers overall have.

- Half (50%) of younger generation shoppers who purchased secondhand apparel in the last 12 months purchased to create content or share on social media.

- 76% of retail executives say social commerce will play a significant role in driving resale adoption within their brand.

- 38% of retail executives allow customers to shop secondhand through a social commerce platform. Another 48% are considering integrating social commerce in the future.

- 22% of retail executives believe social commerce will generate meaningful (> 10% of total) revenue within the next 3 years.

AI is driving resale adoption by reducing thrift overwhelm and bridging the gap between shopping used and new.

- 48% of consumers say personalization, improved search, and discovery make shopping secondhand apparel as easy as shopping new. 59% of younger generations say this.

- 46% of consumers say if they can find an item secondhand, they won’t buy it new. 55% of younger generations say this.

- 78% of retailers have already made significant investments in AI; and 58% plan to launch AI-powered tools in the next year.

- 62% of retailers agree that AI has the power to make the secondhand shopping experience more appealing.

- 44% of retailers agree that AI bridging the gap between secondhand and new apparel.

To see the 2025 Resale Report, visit thredup.com/resale.

About the 2025 Resale Report

ThredUp’s annual Resale Report contains research and data from GlobalData, a third-party retail analytics firm. GlobalData’s assessment of the secondhand market is determined through consumer surveys, retailer tracking, official public data, data sharing, store observation, and secondary sources. These inputs are used by analysts to model and calculate market sizes, channel sizes, and market shares. Further, for the purpose of this report, GlobalData conducted a January-February 2025 survey of 3,034 American adults over 18, asking specific questions about their behaviors and preferences for secondhand. GlobalData also surveyed the top 50 U.S. fashion retailers and brands from January-February 2025 to gather their opinions on resale. In addition, ThredUp’s Resale Report also leverages data from internal ThredUp customer and brand performance data.

About ThredUp

ThredUp is transforming resale with technology and a mission to inspire the world to think secondhand first. By making it easy to buy and sell secondhand, ThredUp has become one of the world’s largest online resale platforms for apparel, shoes and accessories. Sellers love ThredUp because we make it easy to clean out their closets and unlock value for themselves or for the charity of their choice while doing good for the planet. Buyers love shopping value, premium and luxury brands all in one place, at up to 90% off estimated retail price. Our proprietary operating platform is the foundation for our managed marketplace and consists of distributed processing infrastructure, proprietary software and systems and data science expertise. With ThredUp’s Resale-as-a-Service, some of the world’s leading brands and retailers are leveraging our platform to deliver customizable, scalable resale experiences to their customers. ThredUp has processed over 172 million unique secondhand items from 55,000 brands across 100 categories. By extending the life cycle of clothing, ThredUp is changing the way consumers shop and ushering in a more sustainable future for the fashion industry.

Forward-Looking Statements

This release contains forward-looking statements. Forward-looking statements include all statements that are not historical facts. The words “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “predict” and similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions. Except as required by law, ThredUp has no obligation to update any of these forward-looking statements to conform these statements to actual results or revised expectations.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250319230685/en/

Media Contact

Christina Berger

[email protected]

Investor Relations Contact

Lauren Frasch

[email protected]

Resale-as-a-Service Contact

Christine Iovino

[email protected]

KEYWORDS: United States North America California

INDUSTRY KEYWORDS: Software Artificial Intelligence Data Management Technology Electronic Commerce Online Retail Fashion Retail

MEDIA:

| Photo |

|

| U.S. online resale saw accelerated growth in 2024 for the second consecutive year. |

| Photo |

|

| Brands across the apparel ecosystem are performing well in the resale market. |

| Photo |

|

| Younger shoppers are turning to social platforms to buy secondhand apparel. |

| Photo |

|

| AI is driving resale adoption by bridging the gap between shopping secondhand and new. |

| Logo |

|