Karora will host a call/webcast on November 12, 2020 at 10:00 a.m. (Eastern Time) to discuss the third quarter results. North American callers please dial: 1-888-231-8191, international callers please dial: (+1) 647-427-7450. For the

webcast of this event click [here]

(replay access information below).

TORONTO, Nov. 12, 2020 /CNW/ – Karora Resources Inc. (TSX: KRR) (“Karora” or the “Corporation”) is pleased to announce its financial results and review of activities for the three and nine months ended September 30, 2020. All amounts are expressed in Canadian dollars, unless otherwise noted. For additional information please refer to Karora’s Management’s Discussion & Analysis (“MD&A”) and unaudited condensed interim consolidated financial statements for the three and nine months ended September 30, 2020 and 2019.

Highlights

-

Third quarter 2020 consolidated gold production was 24,717 ounces. During the first nine months of 2020 gold production was 73,612 ounces, or 80% of the mid-point of annual guidance of 90,000 to 95,000 ounces, which is maintained (assuming no significant interruption in operations as a result of the COVID-19 virus)

-

Third quarter gold sales of 22,912 ounces were 1,805 ounces lower than ounces produced due to timing of sales which is expected to be captured in the fourth quarter

-

Record low consolidated all-in-sustaining-costs (“AISC”)1 of US$1,044 per ounce since acquiring the Higginsville mill. AISC continued to trend lower despite unfavourable foreign exchange impacts compared to the second quarter which accounted for an additional US$84 per ounce due to an 8% swing in the AUD:USD exchange rate

-

Karora maintains its 2020 cost guidance of US$1,050–US$1,200 per ounce and continues to target AISC costs of approximately US$1,000 per ounce by the end of 2020

-

Net earnings of $34.9 million, or $0.24 per share for the third quarter of 2020, up $25.1 million from $9.8 million in the second quarter of 2020

-

Record adjusted earnings before interest, taxes, depreciation and amortization (“EBITDA”)1 of $23.1 million or $0.16 per share for the third quarter of 2020, up $5.8 million from $17.3 million in the second quarter of 2020

-

Significantly strengthened cash position and balance sheet: Karora ended the third quarter of 2020 with a strong cash position of $67.3 million, an improvement of $17.1 million from June 30, 2020, and working capital was flat at $43.7 million

-

In the third quarter of 2020 the Corporation’s Beta Hunt mine reversed an impairment on its mineral property of $36.1 million based on an impairment assessment conducted in the third quarter of 2020. The after tax amount was $25.3 million. The initial impairment was recognized in the fourth quarter of 2017.

-

Announced new high grade gold discoveries (Larkin Gold Zone, new Footwall Zone in Western Flanks North) and first new nickel discovery in 13 years (30C Nickel Trough) at the Beta Hunt Mine. The discoveries are in close proximity to existing mine infrastructure

-

New coarse gold occurrence: On November 2, 2020, Karora announced that underground development at the Beta Hunt Mine intersected an estimated 2,000 ounces of coarse gold. The coarse gold was found in the same geological environment as previously announced coarse gold occurrences and proximal to the 2018 Father’s Day Vein discovery

-

Increased Exploration Budget: As a result of drilling success year to date and the multiple high quality exploration targets across the Western Australian operations, the 2020 exploration budget was increased by approximately 50% to A$15 million from the previous A$9.5–A$10 million budget, with the majority to be spent on HGO drill targets

-

Spargos Reward acquisition completed on August 7, 2020: Spargos Reward is a high-grade open pit gold project in Western Australia that is expected to begin generating positive cash flow for Karora in 2021

-

Royalty reductions: An agreement to reduce the Beta Hunt gold royalty by 2.75% (from 7.5% to 4.75%) effective July 1, 2020 was completed on September 3, 2020. During the second quarter of 2020 the Corporation eliminated the Morgan Stanley Capital Group Inc. (“Morgan Stanley”) NSR (“Net smelter royalty”) gold royalty on the Higginsville properties. The 110,000 ounce participation payment arrangement with Morgan Stanley remains in place.

-

On November 9, 2020, Karora completed a re-purchase of the 3% gross gold royalty held by Ramelius Resources Limited in respect of the Spargos Reward Gold Project (acquired by Karora in August 2020) via payment of A$3 million, satisfied with A$2 million in cash and 264,187 Karora Shares.

-

Sale of remaining interest in Dumont Nickel Project: on July 27, 2020, Karora closed the sale of its 28% interest in the Dumont Nickel Project for proceeds of up to $47.6 million. Karora immediately received $10.7 million in cash, comprised of $7.4 million from Waterton for its interest and a $3.3 million refund of Karora’s share of the cash held within the Dumont Joint Venture. On a future sale or other monetization event, the Corporation will be entitled to receive 15% of the net proceeds from the transaction (net of certain agreed costs and deductions) up to a maximum of an additional US$30 million.

-

Effective July 31, 2020, the Corporation completed a consolidation of its outstanding common shares on the basis of one (1) post-consolidation common share for every four point five (4.5) pre-consolidation common shares. The exercise price and the number of common shares issuable under any of the Corporation’s outstanding share-based securities such as warrants, stock options and restricted share units, as applicable, have been proportionately adjusted.

- Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section 14 of Karora’s MD&A dated November 12, 2020.

Paul Andre Huet, Chairman & CEO, commented: “I am very pleased with our strong operational and financial performance for the third quarter. We continued to deliver operationally robust gold production and continued our trend of reducing costs, despite challenges associated with COVID-19 and the impact of a stronger Australian dollar during the quarter, which negatively affected our US dollar cost reporting. The negative foreign exchange impact added approximately US$78 per ounce and US$84 per ounce to our cash operating costs and AISC, respectively.

Our record adjusted EBITDA of over $23 million demonstrates our cash generating power now that we have full exposure to market gold prices and significantly reduced royalties across our properties in a strong gold price environment.

We have established a strong track record over the last five quarters with our consistent production results and declining costs since we acquired the Higginsville mine and mill in 2019. During the third quarter, we produced 24,717 ounces, for total production during the first nine months of 2020 of 73,612 ounces, representing 82% of the lower end of our 2020 guidance. We did sell 1,805 fewer ounces than we produced due to the timing of sales which we expect to make up in the fourth quarter.

Our downward trend in AISC continued despite the elevated costs associated with important COVID-19 precautions we have in place at our operations and a stronger Australian dollar. AISC of US$1,044 per ounce sold during the quarter was a US$21 per ounce improvement over the second quarter of 2020 and we continue to target reaching our goal of US$1,000 per ounce by the end of 2020.

Following the 50% increase in our 2020 drilling budget to A$15 million announced in September, we are well underway with an aggressive campaign of approximately 50,000 metres to be completed in the fourth quarter. We are beginning to see some impressive results already, including three new discoveries at our Beta Hunt Mine, made up of a gold discovery in a footwall zone in the Western Flanks shear and the new Larkin Gold Zone and 30C Nickel Trough in the interpreted southern extension of the Western Flanks shear. Additionally, an ore drive in the A Zone shear recently intersected an estimated 2,000 ounces of coarse gold in the same geological environment as the Father’s Day Vein discovery. At Higginsville we recently announced positive near surface drilling results at our Aquarius Project which could potentially lead to an economic starter pit, offsetting costs associated with accessing higher grade material underground.

By the end of the year, we expect to provide an updated resource and reserve estimate for our Australian operations that will incorporate this year’s drilling as well as reflect the improved economics of our deposits given our work in reducing royalties across the portfolio.

With Karora’s record cash balance of over $67 million, our consistent gold production with full exposure to market gold prices and an aggressive drill program ongoing, I believe we are well positioned for a very exciting fourth quarter. We have built a solid platform from which we are well positioned to grow the business to the next level as we prioritize our numerous organic growth opportunities.”

COVID-19 Preparedness

Karora’s strict COVID-19 control measures at its operations remain in effect. The measures are in place to ensure operating sites remain as prepared and responsive to the situation as possible. While the situation in Western Australia with respect to COVID-19 continues to be stable, Karora continues to actively monitor the advice of local health authorities and has continued to employ a full-time nurse and supporting medical staff to monitor the status of individuals entering and leaving site. Furthermore, the Corporation’s adjusted rotations for personnel on site, use of chartered Karora-only flights where prudent, remain in place to help ensure the health and safety of its employees and stakeholders, which remains the Corporation’s top priority.

Results of Operations

Table 1 – Highlights of operational results for the periods ended September 30, 2020 and 2019

|

|

Three months ended,

|

Nine months ended,

|

|

For the periods ended September 30,

|

2020

|

2019

|

2020

|

2019

|

|

Gold Operations (Consolidated)

|

|

|

|

|

|

Tonnes milled (000s)

|

354

|

296

|

994

|

435

|

|

Recoveries

|

92%

|

92%

|

92%

|

92%

|

|

Gold milled, grade (g/t Au)

|

2.36

|

2.76

|

2.49

|

2.90

|

|

Gold produced (ounces)

|

24,717

|

24,216

|

73,612

|

37,403

|

|

Gold sold (ounces)

|

22,912

|

22,010

|

70,723

|

36,867

|

|

Average realized price (US $/ounce sold)

|

$1,905

|

$1,339

|

$1,665

|

$1,308

|

|

Cash operating costs (US $/ounce sold)1

|

$972

|

$1,032

|

$957

|

$1,062

|

|

All-in sustaining cost (AISC) (US $/ounce sold)1

|

$1,044

|

$1,159

|

$1,071

|

$1,173

|

|

Gold (Beta Hunt Mine)

1

|

|

|

|

|

|

Tonnes milled (000s)

|

191

|

210

|

563

|

342

|

|

Gold milled, grade (g/t Au)

|

2.75

|

2.93

|

2.95

|

3.07

|

|

Gold produced(ounces)

|

15,525

|

18,460

|

49,514

|

31,352

|

|

Gold sold (ounces)

|

14,502

|

16,593

|

47,603

|

31,155

|

|

Cash operating cost (US $/ounce sold)1

|

$1,035

|

$1,148

|

$985

|

$1,065

|

|

Gold (HGO Mine)

|

|

|

|

|

|

Tonnes milled (000s)

|

163

|

86

|

413

|

93

|

|

Gold milled grade (g/t Au)

|

1.91

|

2.34

|

1.88

|

2.27

|

|

Gold produced (ounces)

|

9,192

|

5,756

|

24,098

|

6,051

|

|

Gold sold (ounces)

|

8,410

|

5,417

|

23,120

|

5,712

|

|

Cash operating cost (US $/ounce sold)1

|

$863

|

$678

|

$901

|

$1,048

|

|

|

|

|

|

|

|

|

1.

|

Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section 14 of Karora’s MD&A dated November 12, 2020.

|

Higginsville (“HGO”)

During the third quarter of 2020, 200 kt was mined and 163 kt of HGO material was milled at a grade of 1.91 g/t for production of 9,192 ounces of gold. Cash costs for the quarter were US$863 per ounce.

Production from the Baloo open pit contributed 128 kt in the quarter. A re-optimization of the pit was completed and additional mineralization identified in the northern portion of the pit which has driven the development of a new ramp from the south. Further exploration drilling will be conducted during the fourth quarter to test the eastern margins of the main mineralized zone. Drilling during the third quarter at Baloo was limited to grade control holes.

At Hidden Secret, a staged pre-stripping program to access the near surface mineralization commenced in August 2020. At Mousehollow, an open pit optimization has been completed and a mining proposal submitted to the appropriate authorities. Mining approval is expected in the fourth quarter of 2020. Once online, these combined pits will provide Karora with additional operational flexibility and mill feed optimization in addition to existing production from Baloo and Fairplay North.

Beta Hunt

During the third quarter of 2020, 191 kt of Beta Hunt material was milled at a grade of 2.75 g/t for production of 15,525 ounces of gold. Mined production from Beta Hunt was 199 kt during the quarter, a 16% increase compared to the prior quarter. The ramp up in production is a direct reflection of improved mining techniques and the addition of a CAT R2900 underground loader into the mining fleet.

Nickel production at Beta Hunt is currently restricted to remnant nickel resources south of the Alpha Fault, however, recent drilling has identified a number of new areas including the 30C Nickel Trough, where production can potentially be increased. A revised nickel production strategy, which is expected to provide a by-product credit towards gold production costs, will be based on an updated nickel mineral resource, which is expected to be completed in the fourth quarter of 2020.

Subsequent to the end of the third quarter, as announced on November 2, 2020, underground development at the Beta Hunt Mine intersected an estimated 2,000 ounces of coarse gold. The coarse gold occurrence was found in the same geological environment as previously announced coarse gold occurrences and proximal to the 2018 Father’s Day Vein discovery. The new gold occurrence provides further support of Karora’s existing Coarse Gold Geological Model at Beta Hunt which could potentially apply to other areas in the mine.

Consolidated Milling

On a consolidated basis, 354 kt were milled in the third quarter of 2020 at an average gold grade of 2.36 g/t, to produce a total of 24,717 ounces of gold, increases of 9%, 4% and 3%, respectively over the prior quarter. Milling operations had another quarter of very strong cost performance with processing costs of A$21 per tonne which was in line with the second quarter and a marked improvement compared to A$27 per tonne in the first quarter of 2020. For the third quarter, the HGO mill feed was approximately 54% Beta Hunt material and approximately 46% HGO open pit material.

Overall, Western Australia’s operational performance met or exceeded targets throughout the quarter despite the additional cost and business disruption associated with the COVID-19 pandemic which included both restricted access to certain equipment and higher cost skilled labour experienced across the State of Western Australia.

Cash Operating Costs and AISC

Cash operating costs1 and AISC1 were US$972 and US$1,044 per ounce sold respectively on a consolidated basis for the third quarter of 2020.

During the third quarter the US dollar weakened by approximately 8% against the Australian dollar when compared to the second quarter. This negatively impacted US dollar cash operating costs and all-in sustaining costs for the third quarter by approximately US$78 per ounce and US$84 per ounce, respectively. Despite this, cash operating costs1 were only 4% higher compared to the second quarter and AISC1 was 2% lower compared to the second quarter.

Outlook and New Regional Mining Strategy

Following a strong operating performance over the first three quarters of 2020 with total gold production of 73,612 ounces at an AISC1 of US$1,071 per ounce, Karora is maintaining its consolidated production and cost guidance for its Australian operations (Beta Hunt and HGO) of 90,000 to 95,000 ounces of gold at an average AISC1 of US$1,050 to US$1,200 per ounce sold. Karora continues to target AISC1 costs of approximately US$1,000 per ounce sold by the end of 2020.

As announced on November 9, 2020, a new regional mining strategy aimed at optimizing mine-to-mill feed is being developed for Karora’s 1.4 Mtpa HGO treatment plant. With the increasing number of current and planned production sources from Higginsville, Beta Hunt and Spargos, all competing for a share of the feedstock, the new strategy divides Karora’s regional operating and near-term mining areas into four main mining centres:

-

Higginsville Central – This area is the main focus for resource definition and conversion of resources to reserve drilling and includes multiple existing and potential future open pits and underground mines (including the Aquarius deposit) contained within an approximate 10 kilometre radius of the HGO treatment plant.

-

Higginsville Greater – This area covers all remaining projects and deposits outside Higginsville Central. However, given its vast tenement area and large number of existing and potential resource targets, this area may be further sub-divided over time. Deposits such as Baloo and the Lake Cowan prospects fall within Higginsville Greater.

-

Beta Hunt – The Beta Hunt underground mine.

-

Spargos – Acquired in August 2020 and a potential source of short term, high grade mill feed to HGO.

Karora will provide further details on the new regional mining strategy following the updated resource and reserve estimate expected later in the fourth quarter.

HGO Exploration

At Aquarius, a successful near surface drilling program completed during the third quarter outlined the potential for an economic starter pit which could offset costs associated with accessing the higher grade material underground. The near surface drilling identified high grade supergene gold mineralization, including 43.5 g/t over 3.0 metres and 5.7 g/t over 6.0 metres (which included 14.6 g/t over 2.0 metres). For further details on the results, see Karora news release dated November 9, 2020. Development of the Aquarius starter pit could commence as early as mid-2021.

The existing Aquarius historical mineral resource 2 3 is 20 kt @ 19.5 g/t (Measured and Indicated) and 43 kt @ 4.2g/t (Inferred).

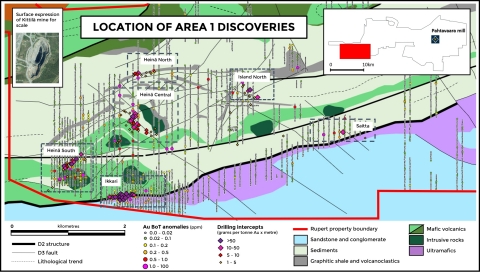

Beyond Aquarius, limited exploration drilling was undertaken during the third quarter at HGO owing to the utilization of the drill rigs primarily for infill and grade control drilling at Baloo, Fairplay North, Hidden Secret and Mousehollow. Exploration drilling is scheduled to ramp up in the fourth quarter of 2020 with the mobilization of additional drill rigs. Figure 1 below shows some of the areas where Karora is either actively advancing or evaluating high-priority exploration targets at HGO during the fourth quarter following the announcement in September of an expanded 2020 exploration budget to A$15 million.

|

_________________________________

|

|

1 Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section 14 of Karora’s MD&A dated November 12, 2020.

|

|

2 Karora Resources profile at www.sedar.com technical report, February 6, 2020.

|

|

3 Westgold 2018 Annual Update of Mineral Resources & Ore Reserves dated October 2, 2018, available to view on the ASX (www.asx.com.au). A qualified person has not done sufficient work on behalf of Karora to classify the historical estimate noted as current mineral resources and Karora in not treating the historical estimates as current mineral resources.

|

Beta Hunt Exploration

Drilling at Beta Hunt during the third quarter was focused on upgrading and extending the northern margin of the Western Flanks mineral resource and testing nickel trough targets on the basalt/ultramafic contact south of the Alpha Island Fault. The drilling was successful in discovering new footwall mineralization associated with the Western Flanks mineral resource, while the nickel targeted drilling made the first new nickel discovery in 13 years (30C Nickel Trough) and, concurrently, also delineated a new gold system – the Larkin Gold Zone – directly below the 30C Nickel Trough. Please see Karora’s news releases dated September 8 and 10, 2020 for further details on the strong new discoveries made at Beta Hunt.

Exploration and resource definition drilling in the fourth quarter is directed at testing the northern, up-plunge extent of the A Zone, from both underground and surface positions, extending the southern margin of Western Flanks, testing additional nickel targets south of the Alpha Island Fault and testing the potential along strike and down-dip potential of the newly discovered Larkin Gold Zone.

Results from drilling completed will be incorporated into an updated Beta Hunt Mineral Resource and Reserve statement aimed to be released in later in the fourth quarter.

Spargos Reward Gold Project

The Spargos Reward acquisition was completed on August 7, 2020. Spargos is a historic high-grade open pit and underground gold project located approximately 50 kilometres north of Higginsville.

Karora recently negotiated the acquisition and elimination of a 3% gold royalty covering the Spargos Reward tenement for consideration of A$3 million, satisfied with A$2 million in cash and 264,187 common shares of the Corporation. Much like the elimination of the Morgan Stanley NSR previously negotiated at Higginsville, the Corporation anticipates that this will both further improve the expected strong pit economics, as well as drive further exploration successes across the Spargos land package.

An infill and extensional drilling program to convert historical mineral resources to mineral reserves is underway. A revised resource and reserve statement is expected to be completed in the fourth quarter and will form the basis of an initial mine plan. The Corporation expects to begin mining activities at Spargos in the second quarter 2021.

Financial Highlights

Table 2 – Highlights of Third Quarter Financial Results

(in thousands of dollars except per share amounts)

|

For the periods ended

September 30, 2020

|

Three months ended,

|

Nine months ended,

|

|

2020

|

2019

|

2020

|

2019

|

|

Revenue

|

59,405

|

43,092

|

169,787

|

71,204

|

|

Production and processing costs

|

28,032

|

26,670

|

81,093

|

47,212

|

|

Earnings (loss) before income taxes1

|

50,208

|

(1,557)

|

68,334

|

(17,482)

|

|

Net earnings (loss)1

|

34,867

|

(1,378)

|

45,224

|

(17,407)

|

|

Net earnings (loss) per share – basic

|

0.24

|

(0.01)

|

0.33

|

(0.15)

|

|

Net earnings (loss) per share – diluted

|

0.24

|

(0.01)

|

0.32

|

(0.15)

|

|

Adjusted EBITDA2,3

|

23,097

|

4,021

|

55,901

|

(2,758)

|

|

Adjusted EBITDA per share – basic2,3

|

0.16

|

0.03

|

0.41

|

(0.02)

|

|

Cash flow provided by (used in) operating activities

|

20,827

|

2,072

|

54,125

|

(5,942)

|

|

Cash investment in property, plant and equipment and mineral property interests

|

(32,333)

|

(4,221)

|

(50,558)

|

(17,615)

|

|

|

|

|

1.

|

For 2020, Earnings (loss) before income tax include an impairment reversal of $36.1 million and net earnings include an after tax impairment reversal of $25.3 million.

|

|

2.

|

Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section of Karora’s MD&A dated November 12, 2020.

|

|

3.

|

Earnings before interest, taxes, depreciation, and amortization (“EBITDA”).

|

During the third quarter, Karora reversed an impairment on its Beta Hunt mineral property totaling $36.1 million based on an impairment assessment conducted during the quarter. After tax, the amount totaled $25.3 million based on the Australian corporate tax rate of 30%. The initial impairment was originally recognized in the fourth quarter of 2017.

Record adjusted EBITDA of $23.1 million was up 47% over the second quarter (and by $21.4 million over the corresponding 2019 period). Consolidated gold sales were 1,805 ounces less than gold produced during the third quarter (22,912 ounce sold versus 24,717 ounces produced) due to the timing of deliveries to the Perth Mint. The Corporation expects to sell these ounces during the fourth quarter.

Table 3 – Highlights of Karora’s Financial Position

(in thousands of dollars):

|

|

|

|

|

For the period ended

|

September 30, 2020

|

December 31, 2019

|

|

Cash and cash equivalents

|

67,299

|

34,656

|

|

Working capital1

|

43,739

|

26,506

|

|

PP&E & MPI

|

223,046

|

98,955

|

|

Total assets

|

315,849

|

177,777

|

|

Total liabilities

|

158,640

|

85,495

|

|

Shareholders’ equity

|

157,209

|

92,282

|

|

|

|

|

1

|

Working capital is a measure of current assets (including cash and cash equivalents) less current liabilities.

|

Karora finished the third quarter of 2020 with a strong cash position of $67.3 million, an increase of $17.1 million compared to June 30, 2020. As at September 30, 2020, Karora had a working capital surplus of $43.7 million.

For a complete discussion of financial results, please refer to Karora’s MD&A and unaudited condensed interim financial statements for the three and nine months ended September 30, 2020 and 2019.

Conference Call / Webcast

Karora will be hosting a conference call and webcast today beginning at 10:00 a.m. (Eastern time). A copy of the accompanying presentation can be found on Karora’s website at www.karoraresources.com.

Live Conference Call and Webcast Access Information:

North American callers please dial: 1-888-231-8191

Local and international callers please dial: 647-427-7450

A live webcast of the call will be available through Cision’s website at:

Webcast Link

(https://produceredition.webcasts.com/starthere.jsp?ei=1394286&tp_key=363b46ced6)

A recording of the conference call will be available for replay through the webcast link, or for a one-week period beginning at approximately 1:00 p.m. (Eastern Time) on November 12, 2020, through the following dial in numbers:

North American callers please dial: 1-855-859-2056; Pass Code: 6191855

Local and international callers please dial: 416-849-0833; Pass Code: 6191855

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

About Karora Resources

Karora is focused on growing gold production and reducing costs at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations (“HGO”) in Western Australia. The Higginsville treatment facility is a low-cost 1.4 Mtpa processing plant which is fed at capacity from Karora’s underground Beta Hunt mine and open pit Higginsville mine. At Beta Hunt, a robust gold mineral resource and reserve is hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial historical gold resource and prospective land package totaling approximately 1,800 square kilometers. Karora has a strong Board and management team focused on delivering shareholder value. Karora’s common shares trade on the TSX under the symbol KRR. Karora shares also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains “forward-looking information” including without limitation statements relating to the liquidity and capital resources of Karora, production guidance and the potential of the Beta Hunt Mine, Higginsville Gold Operation, the Aquarius Project and the Spargos Gold Project.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ‘s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Cautionary Statement Regarding the Higginsville Mining Operations

A production decision at the Higginsville gold operations was made by previous operators of the mine, prior to the completion of the acquisition of the Higginsville gold operations by Karora and Karora made a decision to continue production subsequent to the acquisition. This decision by Karora to continue production and, to the knowledge of Karora, the prior production decision were not based on a feasibility study of mineral reserves, demonstrating economic and technical viability, and, as a result, there may be an increased uncertainty of achieving any particular level of recovery of minerals or the cost of such recovery, which include increased risks associated with developing a commercially mineable deposit. Historically, such projects have a much higher risk of economic and technical failure. There is no guarantee that anticipated production costs will be achieved. Failure to achieve the anticipated production costs would have a material adverse impact on the Corporation’s cash flow and future profitability. Readers are cautioned that there is increased uncertainty and higher risk of economic and technical failure associated with such production decisions.

SOURCE Karora Resources Inc.